Climate change increasingly presents financial and operational risks to supply chains around the world.

ESG (Environmental, Social, and Governance) criteria are now a core driver of asset managers’ investment processes. The continually accelerating focus on our changing Earth has led to the development and application of new and novel technology for solving once-intractable environmental problems that impact specific companies and society broadly.

Geospatial AI is an example of such a technology. Well established as a niche field of academic study, the use of geospatial AI — extracting information from satellite imagery, geolocation information, and other sources — is only recently being explored within the domain of sustainable finance. Combining the birds-eye view provided by imagery with information on ground conditions provides the basis for training geospatial AI algorithms that can explore many paths to solving difficult problems.

The implementation of geospatial AI confronts unique challenges. Not all things look the same in imagery; it can be difficult to classify the species of a single tree or detect a surfacing humpback whale using a space-borne camera. Even within a certain class of “objects”, like heavy-carbon-emitting cement plants that are likely to become stranded assets, the degree of variation within and across geographies makes it difficult to leverage a machine-learning algorithm to achieve global scale.

At Astraea, we specialize in developing and deploying thoughtful approaches to difficult problems.

Over the last two years, we have worked with a consortium of collaborators from leading academic institutions to design and implement a geospatial AI solution to a unique environmental challenge: localizing cement plants in under-reported regions of the world.

The SFI consortium aims to mainstream geospatial capabilities enabled by space technology and data science into financial decision-making globally.

The Spatial Finance Initiatives and its partners are leveraging their expertise and networks across technology providers, academia, and the finance industry to address current data challenges within the financial sector and translate those into practical solutions.

Included in the group are The Alan Turing Institute, Green Finance Institute, Satellite Applications Catapult, and the University of Oxford Smith School of Economics.

Develop an open-source dataset to build improved transparency on carbon emissions from cement plants at the asset level.

Current asset-level datasets for cement production only cover approximately 70% of global assets, with significant gaps in certain regions (in particular China with ~50% coverage). Furthermore, the information provided in these datasets is often inadequate for various types of risk analyses.

Cement production accounts for ~8% of global CO2 emissions annually; the regulatory landscape and consumer preferences for clean energy continue to apply pressure to this heavy-emitting sector. As decarbonization accelerates around the world, these plants may become “stranded assets”.

Unanticipated and sudden shutdowns of these plants, due to pressures like a carbon tax, threatens the stability of downstream supply chains, which fuel the construction of everything from single-family residences to bridges and skyscrapers.

In these scenarios, new production supplants old methods as consumer preference and regulations shift to favor environmentally sustainable production processes. Factories begin to operate at a loss, unable to keep up with these new changes, and companies can no longer operate the plant and will eventually have to write these assets off of their balance sheet — causing a cascading effect as interest rates rise to cover the devalued company’s liabilities. This project identified assets that could soon become stranded.

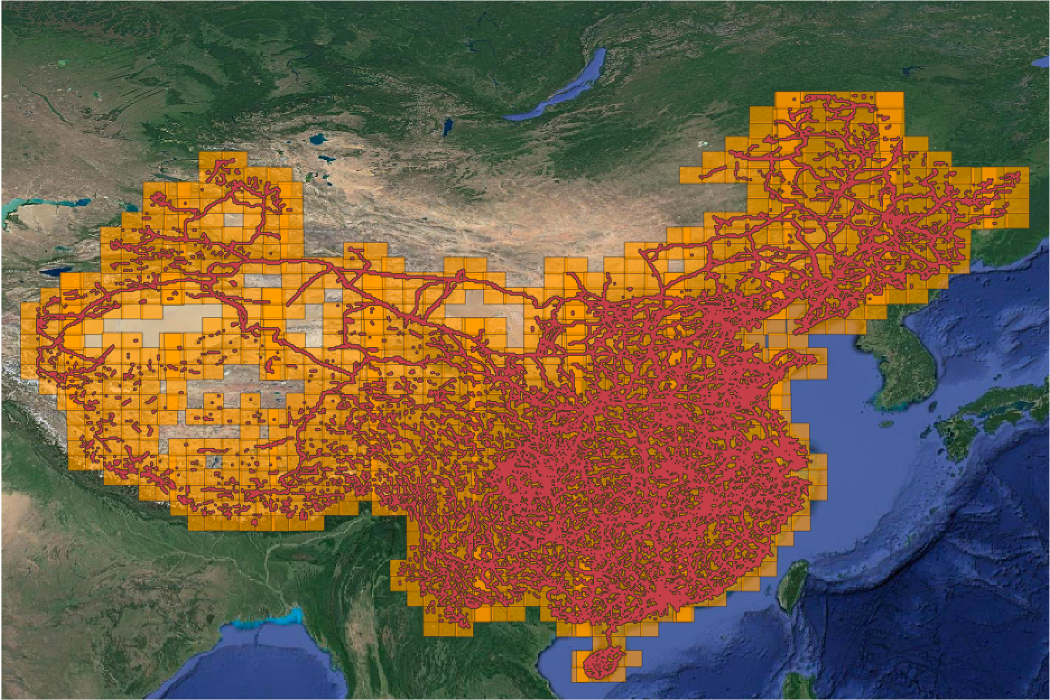

The consortium leveraged open-source databases as initial training data and a web-scraping process was undertaken to identify the owner of each asset. The team then leveraged the data to develop an infrastructure density model that identified areas in China most likely to be near a cement plant. This turned out, unsurprisingly, to be waterways and railroads.

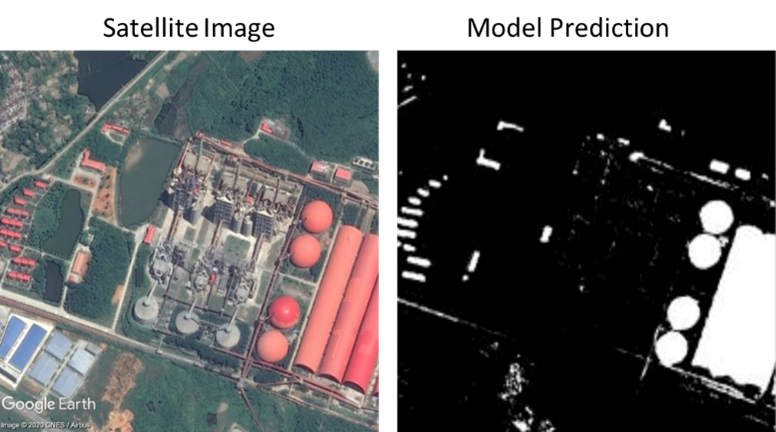

We then used the EarthAI platform to build the cement plant localization model. This is a difficult machine learning problem. Training data is limited and the underlying variation in cement plants is high. While many key features appear in many plants, there are multiple types of production, which translate into different features on the ground.

EarthAI provided the computational horsepower, geospatial toolkit, and collaboration tools that enabled researchers from across the consortium to experiment with various models. The output of this experimentation was a machine learning algorithm that was trained to recognize cement plants in cloud-free satellite imagery captured by the European Space Agency’s Sentinel-2 mission during the summer of 2020.

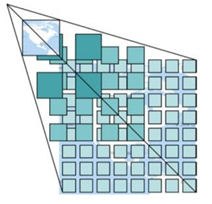

The results of the infrastructure density model allowed us to focus the localization model on the areas most likely to have a cement plant, thereby making the work more computationally efficient. Rather than searching a broad area, we constrained the dimensions of our analysis through our chipping strategy.

Using Sentinel-2 imagery, available from the EarthAI catalog, we created training and validation image chips of the predicted areas that were about 10 square kilometers in ground distance, with three-chip layers corresponding to the red, green, and blue spectral bands. We localized chip creation to the areas predicted by the infrastructure density model.

Using the EarthAI platform, we also resampled the chips to augment our training set, expanding the number and variety of observations fed to the model. This training data augmentation exercise amplified the model’s ability to detect cement plants.

While the model performed well from a technical perspective, there were a variety of other industrial production processes in China (e.g. steel). For this reason, we employed a rigorous human-in-the-loop validation process to ensure that all plants added to the database were indeed cement plants.

Astraea partners with CloudFactory, an outsourced data annotation provider, whose “impact sourcing” model aligns with our business philosophy as a benefits corporation. Leveraging the EarthAI Pulse platform, we had multiple annotators review each image in a streamlined set of tools that facilitated both quality assurance and generation of high-quality information.

Our annotation team delineated specific attributes of each plant (e.g. kilns, preheater towers) that supported Oxford-led modeling of plant capacities, a critical input for carbon emissions estimation. Then experts from Oxford reviewed the results, confirming that the true positives had been correctly identified. The full results of this work (and open-source dataset) will be made available in a future analysis.

With complete global datasets, we can better understand emissions from sectors/regions and improve geospatial risk assessments, including being able to compare which companies and portfolios have the greatest risk(s) and/or impact(s) relevant for a wide range of financial institutions, supervisors, policymakers and civil society users.

While information can be comprehensive in some sectors and geographies, others are opaque. Developing open-source asset-level data sets (e.g. at the cement plant level) enables more informed decision making. As a result, the Spatial Finance Initiative was able to correctly identify hundreds of cement plants in China that had been previously unreported, thereby improving transparency into this heavy-emitting sector.